Oando Acquires Nigerian Agip Oil Company, Awaits Ministerial Consent

Lawyard is a legal media and services platform that provides…

Oando PLC, a leading Nigerian oil & gas company has announced the acquisition of 100% of the shares of Nigerian Agip Oil Company Ltd (NAOC Ltd) from global oil giant, Eni.

Oando, which is listed on both the Nigerian and Johannesburg Stock Exchange, announced its acquisition of the wholly Eni-owned subsidiary focusing on onshore oil & gas exploration and production in Nigeria, as well as power generation, on Monday. Eni also published a statement confirming the transaction on Monday.

In its press statement announcing the transaction, Oando described Eni as an integrated energy company actively supporting a just energy transition, with the objective of achieving Net-Zero carbon emissions by 2050 and promoting efficient and sustainable access to energy for all.

NAOC Ltd is present with interests in Nigeria across 4 onshore blocks (OML 60, 61, 62, 63), which it operates on behalf of NAOC JV (operator NAOC Ltd 20%, Oando 20%, NNPC E&P Limited 60%), in the Okpai 1 and 2 power plants (with a total nameplate capacity of 960MW), and in two onshore exploration leases (OPL 282 and OPL 135, respectively 90% and 48%) for which it also holds operatorship.

NAOC Ltd participating interest in SPDC JV (Shell Production Development Company Joint Venture – operator Shell 30%, TotalEnergies 10%, NAOC 5%, NNPC 55%) is not included in the perimeter of the transaction and will be retained in Eni’s portfolio.

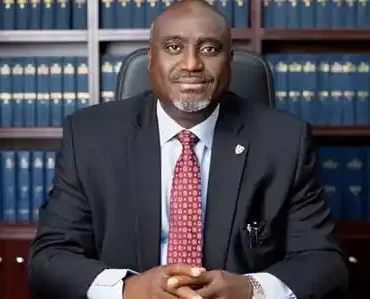

Oando group CEO, Wale Tinubu said the deal would “unlock unparalleled opportunities for us to re-align expectations, enhance efficiency, optimise resource allocation, and significantly increase production.

Furthermore, it is in alignment with our strategy of acquiring, enhancing, appraising, and efficiently developing reserves.”

These four OMLs attributed 24,000 barrels of oil equivalent per day to Eni net in 2022. Production goes to the Obiafu-Obrikom plant and the Brass terminal.

For Oando, the purchase will increase its reserves from 503.3 million boe to 996.2mn boe.

Following the transaction completion with Oando, the Italian company will maintain its presence in Nigeria through Nigerian Agip Exploration (NAE) and Agip Energy and Natural Resources (AENR), reiterating the company’s commitment to its employees health and safety, as well as to the environment.

Eni continues to operate in the country focusing on operated offshore activities. Participation in operated-by-others assets, both onshore and offshore, and Nigeria LNG will remain in Eni portfolio too.

The transaction is consistent with Eni 2023-2026 Plan. The Upstream will supplement the core organically led growth with inorganic high-grading activity, adding resources with incremental value while divesting resources that can offer greater value and opportunities to new owners.

Completion of the transaction is subject to Ministerial Consent and other required regulatory approvals.

Lawyard is a legal media and services platform that provides enlightenment and access to legal services to members of the public (individuals and businesses) while also availing lawyers of needed information on new trends and resources in various areas of practice.