Review of Deduction of Tax at Source (Withholding) Regulations 2024: Implication And Reforms

Lawyard is a legal media and services platform that provides…

Introduction

Withholding tax (“WHT”) in Nigeria, administered under the Companies Income Tax Act (“CITA”) and the Personal Income Tax Act (“PITA”) for corporate and non-corporate recipients, respectively, has recently been enhanced by the Deduction of Tax at Source (Withholding) Regulations 2024 (“Regulations”). Issued by the Honourable Minister of Finance (the “Minister”), these Regulations introduce a robust framework for the deduction of taxes from taxable persons under CITA, PITA, and the Capital Gains Tax Act, offering clear and precise guidelines for compliance and enforcement.

While preserving the existing legal framework, the Regulations establish a primary framework for WHT. They delineate eligible transactions, applicable rates, and the responsibilities of mandated persons. Notably, the Regulations provide exemptions for small companies (companies with a gross turnover of N25,000,000 or less) under specific conditions, marking a significant shift in WHT administration. These conditions include the requirement that the supplier of a product or service (to the small company) must have a valid Tax Identification Number (“TIN”) and that the transaction value must be N2,000,000 or less.

In light of these developments, the Regulations not only consolidate and enhance the WHT system but also set a new standard for tax administration in Nigeria. As the primary legal framework governing WHT, they reflect a deliberate effort to streamline tax processes and support compliance, thereby significantly impacting the tax landscape and business operations within the country.

Key Compliance Requirements

As the Regulations establish a comprehensive framework for WHT, it is crucial for entities to understand and adhere to the specific compliance requirements outlined within these Regulations. These requirements ensure that all parties involved in the deduction and remittance of WHT operate within the legal framework and fulfill their obligations accurately and timely.

This section details the key compliance requirements that must be observed to align with the Regulations. Understanding these requirements is essential for maintaining adherence to tax laws and avoiding potential penalties. The compliance requirements are as follows:

1. Remittance of Withholding Tax: The Regulations mandate the person making the deduction to submit returns and the evidence of remittance to the relevant Tax Authority. Entities are mandated to remit to the Federal Inland Revenue Service (“FIRS”) by the 21st day of the month following the month of payment. Regarding State Boards of Internal revenue Service (“SBIRs”), remittance is to be made not later the 10th day of the month for Capital Gains Tax and Pay-As-You-Earn while, the deadline for any other WHT is the 30th day of the month following the month of payment.

2. Deductions to be receipted: The Regulations impose an obligation on mandated persons to issue receipts for taxes withheld at source (“WHT Receipts”). These WHT Receipts constitute evidence of the deductions and can be presented to the relevant Tax Authorities by the taxed person to obtain a credit note in respect of their taxes. Further, regardless of failure to remit WHT, the beneficiary would still be credited by the relevant tax authority once a receipt has been issued in their favour. The intention is to make it seamless for taxed persons to process credit notes and avoid undue delay and clogs in the filing of tax returns.

3. Timeline for Making Deductions: The obligation to make a deduction arises either immediately when the payment is made or the amount due is otherwise settled, whichever is earlier. For transactions within related parties, the relevant time is when the payment is made or the liability recognised, whichever is earlier.

4. Penalties: The Regulations also revises the penalties for failure to deduct and/or remit WHT to the relevant tax authority. It provides that an administrative penalty and one-off annual interest shall be payable where there is failure to deduct. On the other hand, the deducted amount, an administrative penalty and annual interest shall be payable where thededuction is made but not remitted.

Exemptions

The Regulations also provide for certain transactions to be exempted from the obligation to deduct tax at source. Some of the notable exemptions include the following:

a. Across-the-Counter Transactions – these comprise transaction carried out between parties, in the absence of any prior formal contracting relationship or established contractual relationship. It is also limited to instant payments in cash or electronic payments;

b. Direct debits made by Nigerian banks in respect of interests and fees over funds domiciled in the banks;

c. Goods imported into Nigeria from foreign suppliers who are not construed to have a

taxable presence in Nigeria;

d. Insurance premiums; and

e. Winnings from games of chance or reality show. However, this is limited to contents exclusively designed to promote entrepreneurship, academics, and scientific or technological innovation.

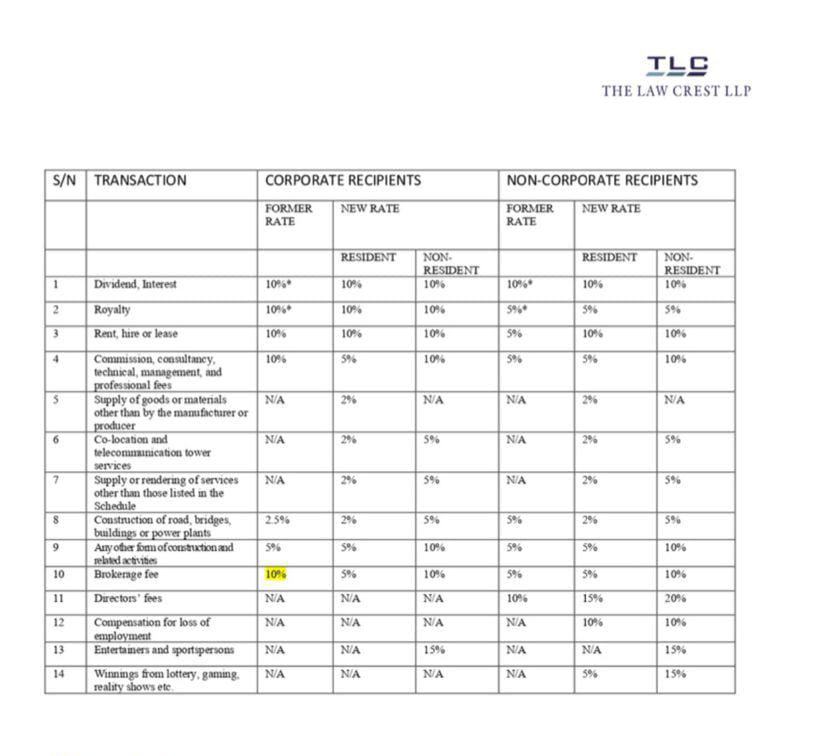

Comparative Analysis of Withholding Tax Rates: Pre- and Post-Regulations2 024

This comparative analysis aims to juxtapose the Withholding Tax rates before and after the Regulations to underscore the changes and their implications for corporate and non-corporate taxpayers. By analysing these variations, stakeholders can better understand the shifts in tax obligations and compliance requirements introduced by the new regulatory framework.

Conclusion

In conclusion, the Regulations consolidate and simplify Nigeria’s tax rules by providing clear guidelines for WHT and introducing new deadlines and penalties. They also offer exemptions for some transactions and small companies, aiming to make tax compliance easier and more efficient.

The information contained herein is general in nature and is not intended, and should not be construed as legal advice or opinion provided by The Law Crest LLP to the reader. The reader is also cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances or needs. The reader should contact a member of The Law Crest LLP’s Tax Advisory Practice team or other solicitors prior to taking any action based upon this information

Lawyard is a legal media and services platform that provides enlightenment and access to legal services to members of the public (individuals and businesses) while also availing lawyers of needed information on new trends and resources in various areas of practice.