CBN Launches Website for Old Naira Notes Deposit Amid Deadline Confusion

Lawyard is a legal media and services platform that provides…

The Central Bank of Nigeria (CBN) is forging ahead with its policy on the old naira notes, having launched a website for bank customers to register to deposit their old notes.

This is coming amid confusion over the deadline of February 10 earlier announced by the apex bank and the Supreme court’s recent ruling on the matter.

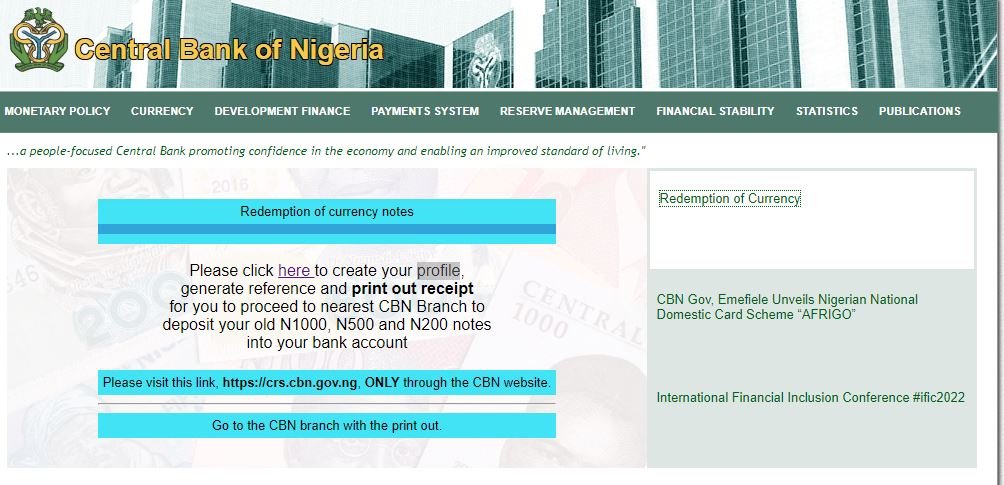

More details: A check on the website by Lawyard showed that the CBN has published a new update titled: ‘redemption of currency’. By clicking on the title, another interface would pop up asking bank customers to click a link “to create your profile, generate reference and print out a receipt for you to proceed to nearest CBN Branch to deposit your old N1000, N500, and N200 notes into your bank account.”

The link leads to a different website with the address: https://crs.cbn.gov.ng/, where a bank customer can create a profile to start the process.

In order to generate a reference number on the website, the user is expected to provide his or her Bank Verification Number (BVN), email address, phone number, bank account details, depositor information (including house address), and the total amount of the denomination to be redeemed.

While there has been no official announcement from the apex bank regarding the collection of the old naira notes or whether the deadline has been extended in line with last week’s Supreme Court order, the website confirms that a viral document circulating on social media on the guidelines for the deposit of the old notes emanated from the CBN, even though it was not officially released.

The circulating guidelines document, which bears the CBN’s logo but without any signature, states:

“Please note that this is a Cash Deposit Program, not a Cash Swap Program. You will not be issued new notes in exchange for old notes, instead, your bank account will be credited after your account is validated by law This process may take up to 4 weeks. If the account validation turns out negative, the Bank will return the deposited notes.

“Members of the public are required to complete an online application form and generate a reference number before coming to the CBN. Where a customer did not pre-fill their condition, he/she will be allowed to fill it at the Branch.

“The Cash Deposit Window is open to the public from February 15-17, 2023 between 9 AM to 2 PM daily.”

It further stated the requirements to approach the CBN for the deposit to include the Reference code generated from the completed online application form filled on CBN Portal; an active Deposit Money Bank account e.g Access, Zenith, GT, Keystone Banks; Bank Verification Number (BVN); and a valid Federal government-issued identity card (NIN, Driver’s License, Voters

Card, International Passport).

The apex bank has neither confirmed nor denied the guidelines document since it started circulating on Tuesday. However, the cash deposit website launched by the bank is in tandem with every point stated in the guidelines.

The launch of the CBN website is coming amidst unconfirmed reports that President Muhammadu Buhari was considering extending the deadline for the old N1,000, N500, and N200 notes to cease to be legal tender to April 10, 2023. The consideration was said to be in a bid to alleviate the sufferings of many Nigerians who have been affected by the policy.

On Wednesday, protests had also broken out in different states of the country as many Nigerians are angered by their inability to collect cash from their banks, while the banks are also rejecting the deposit of old notes from businesses and individuals.

Meanwhile, the Supreme Court on Wednesday said its February 8 order barring the Federal Government and its agencies from enforcing the February 10 deadline for the use of old N200, N500, and N1,000 notes still stands. The Court further fixed February 22 for the hearing of the suit filed by Kaduna, Kogi, and Zamfara states challenging the propriety of the naira swap policy of the Federal Government.

Lawyard is a legal media and services platform that provides enlightenment and access to legal services to members of the public (individuals and businesses) while also availing lawyers of needed information on new trends and resources in various areas of practice.