CBN Orders Full Implementation Cybercrime Act 2024

Lawyard is a legal media and services platform that provides…

The Central Bank of Nigeria (CBN) on Monday, ordered the implementation of 0.5 percent levy on all electronic transactions value as part of efforts to contain the rising threats of cybercrime in the financial system.

The implementation followed the enactment of the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024 and pursuant to the provision of Section 44 (2)(a) of the Act, which provided for the rate deduction.

The development was conveyed in a circular dated May 6, 2024 and addressed to all commercial, merchant, non-interest and payment service banks; other financial institutions, Mobile Money Operators and Payment Service Providers – and jointly signed by CBN Director, Payments System Management Department, Chibuzo Efobi, and Director, Financial Policy and Regulation Department, Haruna Mustafa.

The correspondence also postdates CBN’s circulars of June 25, 2018 and October 5, 2018 on compliance with the Cybercrimes (Prohibition, Prevention, Etc.) Act 2015.

The apex bank. explained that the deducted funds are to be remitted to the National Cybersecurity Fund (NCF), which shall be administered by the Office of the National Security Adviser (ONSA).

Accordingly, all banks, Other Financial Institutions and Payments Service Providers are required to implement the new provision of the Act as directed.

The central bank noted that the levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution.

The deducted amount shall be reflected in the customer’s account with the narration: “Cybersecurity Levy”.

The CBN further clarified that deductions shall commence within two weeks from the date of the circular for all financial institutions and the monthly remittance of the levies collected in bulk to the NCF account domiciled at the CBN by the fifth business day of every subsequent month.

The apex bank further directed that system reconfigurations towards ensuring complete and timely submission of remittance files to the Nigeria Interbank Settlement System (NIBSS) shall be completed within four weeks of the circular for commercial, merchant, non- interest and Payment Service Banks; and Mobile Money Operators.

Also, Other Financial Institutions (Microfinance banks, Primary Mortgage banks, Development Finance Institutions) will be required to effect the completion within eight weeks of the circular.

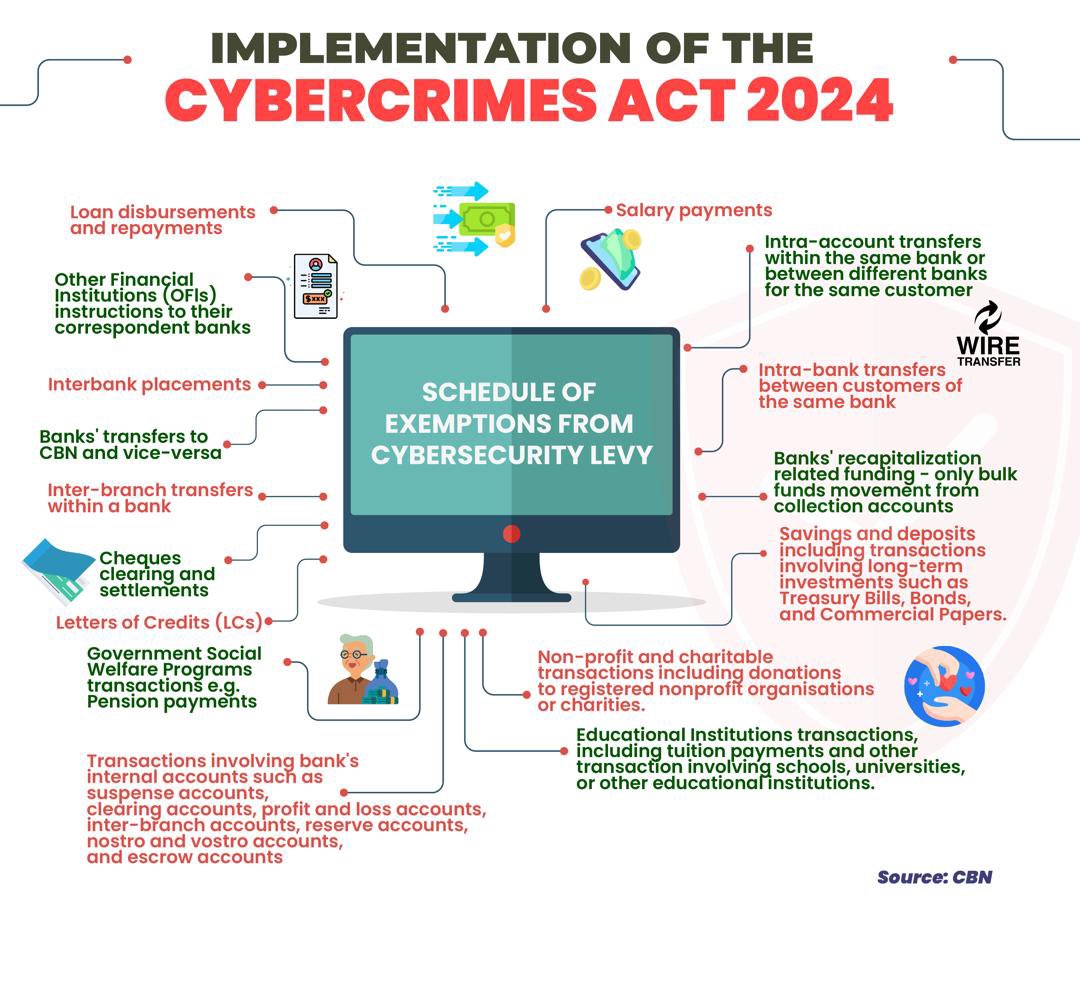

The circular however, exempted some transactions from cybercrime levy.

They included loan disbursements and repayments; salary payments; intra-account transfers within the same bank or between different banks for the same customer; intra-bank transfers between customers of the same bank, and Other Financial Institutions (OFIs) instructions to their correspondent banks.

Exemption also applies to interbank placements; banks’ transfers to CBN and vice-versa; inter-branch transfers within a bank, cheques clearing and settlements; and Letters of Credits (LCs).

Others include banks’ recapitalisation related funding only bulk funds movement from collection accounts; savings and deposits including transactions involving long-term investments such as treasury bills, bonds; and commercial papers; government social welfare programmes transactions e.g. pension payments; non-profit and charitable transactions including donations to registered non- profit organisations or charities; educational institutions transactions, including tuition payments and other transaction involving schools, universities, or other educational institutions.

Transactions involving bank’s internal accounts such as suspense accounts, clearing accounts, profit and loss accounts, inter-branch accounts, reserve accounts, nostro and vostro accounts, and escrow accounts are also exempted from the levy.

The central bank warned that Section 44 (8) of the Act prescribes that failure to remit the levy constitutes an offence liable on conviction to a fine of not less than two per cent of the annual turnover of the defaulting business, among others.

All institutions under the regulatory purview of the CBN are directed to note and comply with the provisions of the Act and the circular.

Lawyard is a legal media and services platform that provides enlightenment and access to legal services to members of the public (individuals and businesses) while also availing lawyers of needed information on new trends and resources in various areas of practice.